Real Value of Due Diligence Procedure for Investors

The research, evaluation and verification of any commercial property or an area is called commercial due diligence. In the commercial due diligence process the information regarding the investment potential of the property is gathered. It is also the strategic research and evaluation of a company as well.

In the process of merging with any company or during the acquisition process, the partners need to know the real situation of the company or the property. The basic objective of commercial due diligence is to guestimate the assets value and obligations of the company.

A good commercial due diligence gives confidence and help to reach a good deal or make good bargain. A commercial due diligence is like a financial measuring of a company and is a valuable support for owners and financial experts. Below are the steps a due diligence process may include but not limited to:

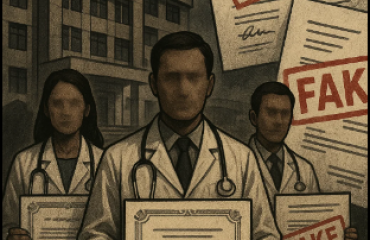

Financial Statement Verification:

Investors are always interested in businesses that make a profit thus they are less attracted to the correctness of financial statements. They are buoyant that the news business can keep generating profits under the present scenario and structure. Investors would make ascertain of the facts by calling the vendors and clients directly. They can also verify income statements, balance sheet, and cash flows during their due diligence process.

Forecast Reports:

The investor may also request a forecast from the company to demonstrate its future growth prospects. They usually demand a five-year forecast plan. Through the forecast plan it is assured that a modest RoE (rate of return) is earned on the capital invested. Moreover a company has a sustainable model that keeps on growing. With the help of a five-year forecast plan, investor can prioritize other areas where a business can excel after acquisition.

Management Structure:

Examining the business structure is also the part of due diligence procedure. An investor scrutinizes the management structure to determine what makes that business works. From investor’s point of view, it is very significant because they want to have competent managers, capable staff and proper authority among management structure. Often such a business is more likely to get new investors which have redundancy and contingency plans.

Contracts & Legal Bindings

The due diligence helps to evaluate the assets, liabilities, legal status, contracts standings, and information about any other legal affairs. Through this information one can establish the risk-factors a company may or may not have. Due diligence also helps to weigh up the value of human capital, company’s environment, its training programs, and growth opportunities. The most important thing a due diligence can reveal is the nature of the competition in the market.

We will not leak your personal information

We will not leak your personal information